In the UK, the household income threshold for student finance influences the amount of financial assistance you receive. While there isn’t a fixed cutoff, higher family earnings typically result in reduced grant funding.

Students from households earning £25,000 or less annually can qualify for the maximum grant. Regardless of income, all students can access loans to cover tuition fees. However, the loan amount for living expenses increases for those with lower household incomes.

For specific thresholds and further details, visit the gov. uk website. Understanding these thresholds is vital for students planning their finances and accessing support for higher education.

What Is Household Income Threshold?

Household income thresholds refer to the maximum income level someone or a family can have to qualify for certain benefits or programs. These thresholds are typically based on a percentage of the median household income (MHI) for a specific area.

Here’s a breakdown of key concepts:

Household Income

This is the combined gross income of all members of a household above a specified age (usually 18 or older). It includes wages, salaries, commissions, unemployment benefits, Social Security, pensions, and other forms of income.

Median Household Income (MHI)

This is the income level at which half of the households in a specific area have an income higher than that amount, and the other half has an income lower than that amount. MHI is a better measure of central tendency than the average (mean) because it’s not skewed by extreme income values.

Thresholds

These are income limits expressed as a percentage of the MHI. Common categories include:

- Extremely Low Income: Typically constitutes 30% or less of the Median Household Income (MHI).

- Very Low Income: Generally refers to 50% or less of the Median Household Income (MHI).

- Low Income: It falls within the range of 50% to 80% of the Median Household Income (MHI).

- Moderate Income: It ranges between 80% and 120% of the Median Household Income (MHI), depending on the specific program or context.

Household Income Thresholds for Student Finance in the UK

Understanding student finance in the UK requires considering your household income. Here’s a breakdown of the thresholds that affect how much support you receive:

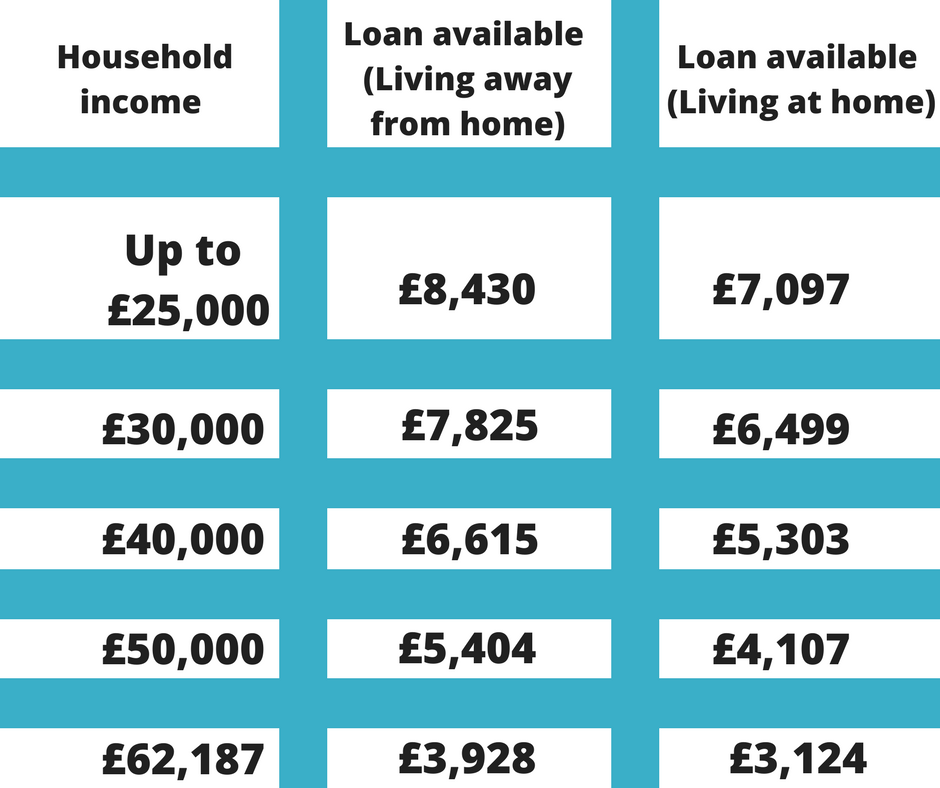

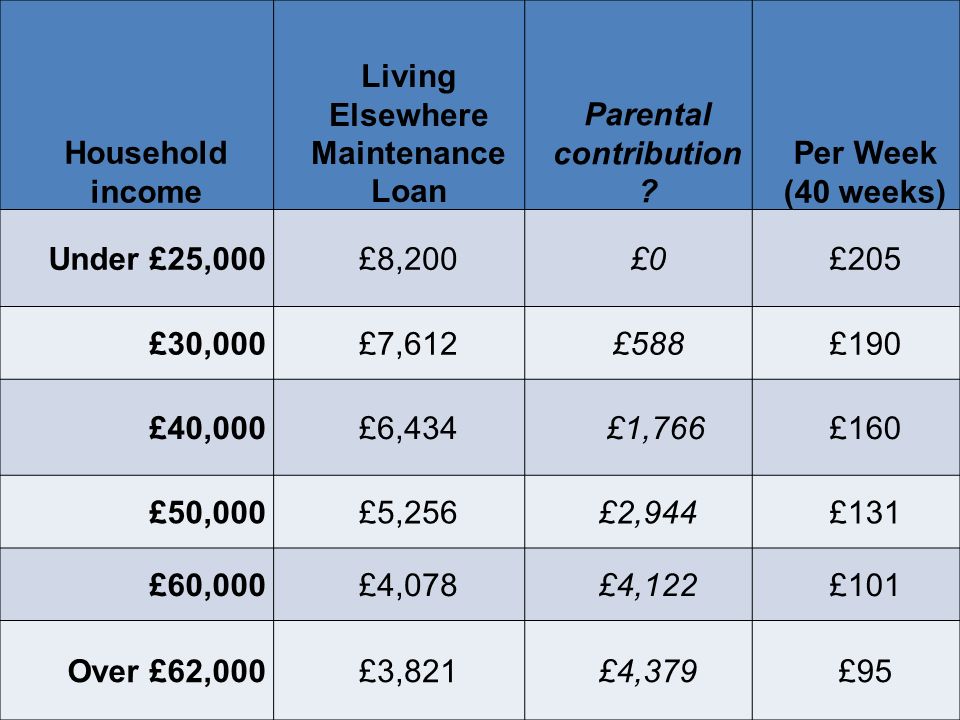

Maintenance Loans

- These loans help cover living costs while studying.

- The amount awarded depends on your household income and living arrangements (at home/away, London/not London).

Thresholds and Loan Amounts

| Living at Home (Outside London) | Living Away from Home (Outside London) | Living Away from Home (London) |

| Below £25,000 | Maximum Loan | Maximum Loan |

| £25,000 – £42,000 | Reduced Loan | Reduced Loan |

| Above £42,000 | Minimum Loan (can not cover all expenses) | Minimum Loan (can not cover all expenses) |

Maintenance Grants:

- These are non-repayable grants for students from lower-income households.

- The full grant is awarded to students from households with income below £25,000 per year.

- The amount gradually reduces as household income increases.

Students from all income backgrounds can apply for student finance, but the amount awarded varies. There are situations where a student’s household income could not be considered (e.g., estranged students, mature students).

What Counts As Household Income?

Household income encompasses various sources of financial resources, including personal savings, investments, and property income such as dividends or rent. Additionally, it can include income from parents or partners, depending on individual circumstances.

For students under 25 years old, household income typically includes:

Parents’ income if the student lives with them or relies on them financially.

The combined income of one parent and their partner if applicable.

However, certain exceptions apply:

- If a student under 25 has financially supported themselves for at least three years, their parent’s income can not be included.

- If the student has been married or in a civil partnership before the course begins, their parent’s income can not be considered.

- If a student spent 13 weeks in local authority care before age 16, they could qualify as a care leaver. In these instances, their parents’ income could not be considered for financial assessments.

- If a student hasn’t talked to their parents for over a year, they can apply as an estranged student. Their parent’s salary could not be taken into account for financial assessments in some circumstances.

For students over 25, household income typically includes their partner’s income if they live together, regardless of the partner’s residency status.

Overall, understanding what counts as household income is crucial for accurately assessing student finance eligibility and entitlements in the UK.

Impact of Household Income on Student Finance

The impact of household income on student finance is substantial and can significantly influence the amount of financial assistance a student receives. Here are key points outlining this impact:

Financial Support Eligibility

Household income often determines eligibility for various types of student finance, including maintenance loans, grants, and bursaries. Those from lower-income households typically qualify for more substantial financial aid packages.

Amount of Financial Aid

Household income plays a pivotal role in determining the amount of financial aid a student receives. Financial assistance programs, like maintenance loans and grants, are usually means-tested. This means they’re awarded based on the student’s household’s financial situation.

Typically, students from families with lower incomes receive larger financial aid packages. This helps cover the costs of attending university, including tuition fees, accommodation, books, and living expenses.

Conversely, students from higher-income households can receive less financial aid or even no aid at all, depending on their household income.

This can result in these students having to rely more heavily on alternative sources of funding. For example, personal savings or private loans, to cover the costs of their education.

Access to Additional Support

Household income can also determine eligibility for additional financial assistance, such as scholarships or hardship funds. These resources can provide support to students facing financial difficulties.

Debt Accumulation

Higher household income levels often translate to lower entitlements to financial aid and a greater reliance on student loans to finance education.

Students from higher-income families can accumulate less debt during their studies. Conversely, those from lower-income backgrounds rely more on grants and loans for expenses.

However, despite lower debt levels, students from higher-income households can still face financial challenges. This is particularly true if they do not qualify for need-based grants or scholarships.

Additionally, students from higher-income households can face pressure to maintain a certain standard of living or fulfill family expectations. This pressure can contribute to financial strain, despite having more resources available to them.

Barriers to Higher Education

Financial constraints imposed by household income can act as barriers to accessing higher education for students from lower-income families. This can perpetuate socio-economic disparities in educational attainment and opportunities.

Student Well-being

Financial worries due to household income can greatly affect students’ overall well-being and academic performance. Managing financial constraints while studying can be overwhelming for students from lower-income families. Concerns about paying tuition fees, rent, and daily expenses can distract from studies and harm mental health.

Similarly, students from higher-income households can also feel stress related to finances, albeit differently. They can struggle with managing personal finances or maintaining a particular lifestyle, impacting their mental well-being and academic success.

Government Policy Impact

Changes in government policies regarding student finance, like adjusting income thresholds or funding allocations, profoundly affect students and families.

Alterations in household income thresholds for financial aid eligibility directly impact access to higher education and the amount of financial assistance received. Also, shifts in government funding for higher education affect the availability of grants, scholarships, and loans.

Moreover, these changes affect students’ decisions on where to study and how to finance education, influencing accessibility, affordability, and fairness.

FAQ’s

What is the income threshold for student loan UK?

The income threshold for receiving the maximum student loan in the UK is £25,000. Beyond this threshold, the size of the maintenance loan decreases on a sliding scale, with higher household earnings resulting in smaller loans. The specific amount depends on the university location and living arrangements.

Does my parents’ income affect my student loan UK?

Yes, the amount of student loan you receive in the UK can be influenced by your parents’ income. Generally, higher family income leads to a reduced loan amount. In cases where the maintenance loan doesn’t cover all costs, parents are expected to contribute to fill the gap.

Who is eligible for a UK student loan?

Full support for a UK student loan is available if you meet certain criteria, including being a UK national, Irish citizen, or having ‘settled status’, and living in England.

Final Words

The household income threshold for student finance in the UK determines the level of financial support students can receive. Those from families earning below £25,000 annually typically qualify for the maximum loan amount. As household income increases within the £25,000 to £42,000 range, the loan amount decreases.

Families earning above £42,000 can receive only a minimum loan, which can not cover all expenses. Understanding these thresholds is essential for students to plan their finances effectively and access the support they need to pursue higher education in the UK.