Taxable turnover is the total income a business earns from its taxable activities, excluding any exempt or non-taxable supplies. This includes revenue from goods and services that would typically be subject to standard-rate, reduced-rate (5%), or zero-rated VAT if the business were VAT registered.

Essentially, it’s the money a business makes from selling goods or services that are subject to VAT. By understanding its taxable turnover, a business can assess its VAT obligations and determine if it needs to register for VAT based on specific thresholds set by tax authorities.

Calculating Taxable Turnover

Taxable turnover is a critical concept for businesses, impacting VAT registration and tax obligations. Here’s a detailed breakdown of how to calculate it:

Understanding the Basics

It represents the total income generated by a business from its taxable activities, excluding certain exempt income. It’s essentially your total sales revenue minus non-taxable income.

This includes income from the sale of goods and services subject to tax (e.g., standard-rated, reduced-rated supplies).

The Value Added Tax (VAT) itself is not part of the taxable turnover calculation.

Calculating Taxable Turnover

Here’s a step-by-step approach to accurately calculate your taxable turnover:

Gather Your Sales Data

Collect all records of income received from selling goods or providing services during the relevant period (e.g., a month, quarter, or year).

This data typically comes from invoices, sales receipts, or your accounting software.

Identify Exempt Income

Not all income is subject to tax. Research and identify any income exempt from the relevant tax in your jurisdiction.

Common examples include income from financial services, insurance sales (in some countries), and charitable donations.

Separate VAT (if applicable):

If your business is VAT-registered, separate the VAT portion from the total sales value on each invoice.

Remember, we only consider the pre-tax amount for taxable turnover calculation.

Subtract Exempt Income and VAT

Once you’ve identified exempt income and separated VAT (if applicable), subtract these amounts from your total sales figure.

Formula

Taxable Turnover = Total Sales – Exempt Income – VAT (if applicable)

Example

- Imagine your business generated a total of $100,000 in sales during a month.

- Out of this, $5,000 came from interest earned on a business bank account (exempt income).

- Additionally, your business is VAT-registered, and the total VAT collected from sales was $15,000.

Here’s the calculation

Taxable Turnover = $100,000 – $5,000 (exempt income) – $15,000 (VAT) Taxable Turnover = $80,000

Therefore, in this example, your taxable turnover for the month would be $80,000.

Additional Considerations

If a customer returns a product or receives a discount, subtract the returned amount or discount value from your total sales before proceeding with the calculation.

For businesses that purchase and sell inventory, the cost of goods sold (COGS) might need to be factored in depending on the specific tax regulations in your country.

Tax laws can vary significantly by location. Consulting a tax professional in your region ensures you’re following the correct guidelines for calculating taxable turnover and meeting your tax obligations.

What is included in taxable turnover?

Taxable turnover encompasses various elements outlined by HMRC for business assessment, including:

- Goods are acquired through barter, exchange, or as gifts for business purposes.

- Goods loaned or rented to customers as part of business operations.

- Goods are purchased for business but also used personally.

- Goods received from abroad are subject to the ‘reverse charge’ mechanism.

- Construction work undertaken by and for the business, exceeding £100,000.

- Zero-rated items sold as part of business transactions. Understanding these components helps businesses accurately determine their taxable turnover for compliance and financial management purposes.

What do I do if my taxable turnover is above the threshold?

If your taxable turnover exceeds the VAT threshold of £85,000, you must register for VAT with HMRC. This can be easily done online via the HMRC website.

Additionally, since April 1st, 2019, it’s mandatory to use HMRC-approved software for submitting VAT returns online, as part of Making Tax Digital. You have 30 days from the point of surpassing the threshold to inform HMRC.

It’s essential to be aware that VAT registration not only affects your ability to claim but may also impact your business’s pricing strategies. Different thresholds apply for specific circumstances such as distance selling or deregistration.

Importance of Taxable Turnover for Businesses

The importance of taxable turnover for businesses can be summarized in two key points:

Financial Health Indicator

Taxable turnover acts as a vital metric for gauging a business’s overall sales activity and financial health. It provides valuable insights by:

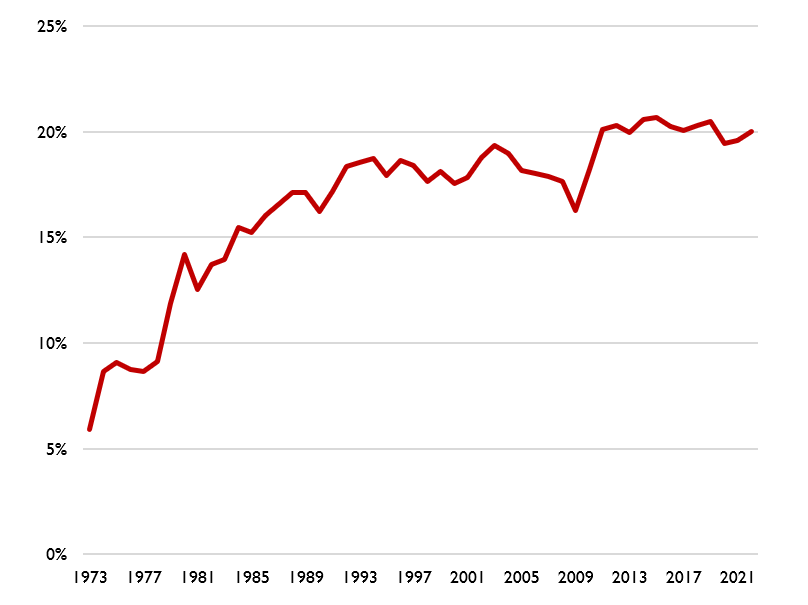

This directly translates to the total income generated through taxable sales. Tracking it over time allows businesses to:

Are sales increasing steadily? Fluctuating significantly? Stagnant? These trends can inform crucial decisions like resource allocation, marketing strategies, or product development.

Businesses can compare their taxable turnover against industry averages or their historical data. This helps them gauge their performance relative to competitors or their past performance, highlighting areas for improvement or celebrating achievements.

VAT Registration Threshold

In many countries, exceeding a specific taxable turnover threshold triggers mandatory Value Added Tax (VAT) registration. VAT is a tax levied on the incremental value added to products or services at each stage of production or distribution.

Understanding the taxable turnover threshold helps businesses determine when they need to register for VAT, ensuring compliance with tax regulations and avoiding potential penalties.

Here’s a breakdown of the consequences of not understanding taxable turnover

Missed Financial Insights

Without monitoring taxable turnover, businesses miss out on valuable data for evaluating sales performance and making informed financial decisions.

Unforeseen Tax Liabilities

If a business unknowingly surpasses the VAT registration threshold, they might face penalties for late registration and non-compliance with VAT obligations.

Navigating Taxable Turnover Key Challenges and Solutions

Determining and managing taxable turnover presents several challenges and considerations for businesses. The complexity arises from varied tax rates, frequent legislative updates, and the intricacies of exemptions and deductions, particularly in international transactions.

Changes in tax laws can significantly impact calculations, requiring businesses to stay informed and adapt quickly. Effective management strategies include regular staff training, advanced tax planning, the use of technological solutions, and seeking professional advice.

Accurate record-keeping and audit readiness are crucial to ensure compliance and avoid penalties. Additionally, understanding the financial impact of taxable turnover is essential for cash flow management, budgeting, and risk mitigation.

By addressing these challenges proactively, businesses can maintain compliance, optimize their tax liabilities, and ensure financial stability.

FAQ’s

What is included in the taxable turnover?

The taxable turnover includes the value of all standard-rated supplies such as revenue, fees, and income from all business activities, rental of commercial properties, and rental of furniture and fittings, all of which are subject to GST at the standard rate (e.g., 7%).

Final Words

Understanding taxable turnover is crucial for businesses to comply with VAT regulations. It represents the total income from taxable activities, excluding exempt or non-taxable supplies.

By knowing their taxable turnover, businesses can assess their VAT obligations and determine if they need to register for VAT. It’s a fundamental aspect of managing finances and ensuring regulatory compliance.