The bedroom tax, also called the under-occupancy penalty, impacts UK social housing tenants receiving benefits who are deemed to have spare bedrooms. It results in a reduction of housing benefits or Universal Credit that covers their rent. If a tenant has one extra room, they lose 14% of benefit support and 25% for two or more.

While the intention was to free up larger homes for families, critics argue that it pushes people into financial hardship. Additionally, there’s a shortage of smaller properties for tenants to downsize to, exacerbating the challenges faced by those affected by the policy.

Policy Overview Of Bedroom Tax

The UK welfare system includes the under-occupancy penalty, also known as the Bedroom Tax, which regulates housing allowances based on occupancy. It aims at reducing housing benefits for tenants deemed to have “spare” bedrooms in their homes. This policy primarily affects individuals living in social housing, including council housing and properties managed by housing associations.

Under the Bedroom Tax policy, tenants face a reduction in their housing benefit. This occurs if they are deemed to have more bedrooms than necessary for their household size.

The reduction is based on the number of spare bedrooms, with a set percentage deducted from the tenant’s housing benefit entitlement. This deduction places the onus on tenants to cover the shortfall from their own incomes, increasing financial strain on already vulnerable households.

The Bedroom Tax poses a significant risk whereby tenants can fall into rent arrears. This is primarily due to the decreased housing benefit payments. Persistent arrears can lead to eviction proceedings, further exacerbating housing insecurity for affected individuals and families.

Moreover, the policy has faced criticism for disproportionately impacting vulnerable groups, including people with disabilities, single parents, and low-income families.

Terminology variations such as “under-occupancy penalty” and “size criteria” are often used interchangeably with Bedroom Tax to describe the same policy. “These terms highlight different aspects of the policy. They emphasize the penalty imposed on tenants for under-occupying their social housing properties. They also highlight the criteria used to assess the size of households relative to their accommodation.

Bedroom tax – number of bedrooms allowed

Under the Bedroom Tax regulations, the number of bedrooms allowed for housing benefit eligibility is determined based on specific criteria:

- Adult couples are generally allocated one bedroom, except when sharing a room due to disability is considered inappropriate. In such cases, one individual receiving a qualifying disability benefit can be exempted. In such instances, two bedrooms can be allowed.

- Each additional adult aged 16 or over in the household, including adult children, is entitled to one bedroom. Stepchildren serving in the armed forces, with intentions to return home, also qualify.

- For children under 10 years old, up to two children can share a bedroom unless sharing is deemed inappropriate due to disability.

- Children under 16 of the same sex can share a bedroom, with the same exceptions related to disability.

- In situations where there are three or more children under 10, additional bedrooms can be allocated.

- A spare bedroom can be allowed for a non-resident carer giving regular overnight care to a disabled person receiving qualifying benefits. Alternatively, an extra bedroom can also be allowed for carers providing care for those receiving attendance allowance at a lower rate. Only one additional bedroom is allowed, regardless of the number of carers required.

Implementation and Controversy

The Bedroom Tax policy, implemented in 2012 under David Cameron’s Premiership, was a pivotal change in UK housing benefit strategies. It was a key component of the Welfare Reform Act, reshaping the landscape of housing assistance. Under this policy, tenants living in social housing were subject to reduced housing benefits.

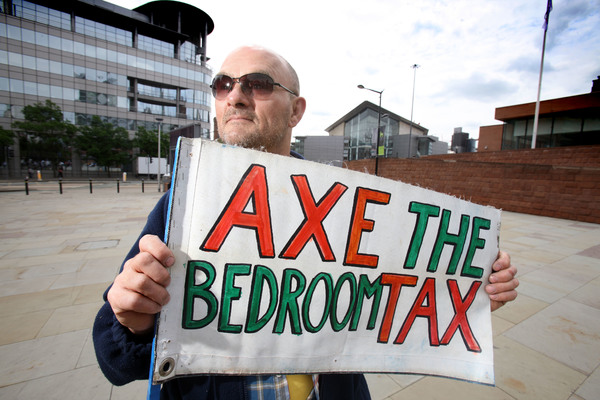

Further, this reduction was implemented if they were deemed to have more bedrooms than required for their household size. The introduction of the Bedroom Tax sparked considerable controversy and public debate.

Opponents of the policy criticized the term “bedroom tax” for inaccurately framing the reduction in housing benefits. They argued that it portrayed the measure as punitive, targeting individuals based on their living arrangements.

Critics contended that many affected tenants had little control over their housing options, with a shortage of smaller properties available for downsizing.

Moreover, the policy encountered opposition due to worries about its effect on vulnerable groups like those with disabilities and low-income families. Critics highlighted cases where individuals faced significant financial hardship. They were forced to choose between paying the rent shortfall and meeting other essential expenses, leading to increased poverty and housing instability.

In comparison to the Local Housing Allowance (LHA) in private-sector housing, the Bedroom Tax differs in several key aspects. Bedroom Tax targets social housing tenants, aiming to reduce underutilization of housing stock, and controlling housing benefit expenditure.

In contrast, the LHA applies to tenants renting from private landlords. It sets a maximum amount of housing benefit based on local rent levels, regardless of the size of the property.

The controversy surrounding the Bedroom Tax underscores broader debates about social welfare policies and housing affordability. It also highlights the delicate balance between incentivizing efficient resource use and ensuring the welfare of vulnerable individuals and families. Efforts to alleviate concerns and lessen its impact notwithstanding, the policy remains a contentious and scrutinized aspect of the UK’s social policy.

Impact and Reforms of the Bedroom Tax

The Bedroom Tax, officially known as the under-occupancy penalty, has had significant effects on tenants and prompted reforms in the UK’s welfare system.

Reduction Percentages Based on the Number of Spare Bedrooms

The Bedroom Tax policy implements reduction percentages for housing benefits based on the number of unused bedrooms in a tenant’s home.

Tenants with one spare bedroom see a 14% cut in housing benefit, while those with two or more spare bedrooms face a 25% reduction.

These reductions aim to encourage tenants to move to properties that better match their household size, thereby reducing housing benefit expenditure.

Impact on Working-Age Tenants

Working-age tenants have been significantly affected by the Bedroom Tax, facing financial difficulties due to reduced housing benefit payments.

Many working-age tenants struggle to cover the rent shortfall caused by the Bedroom Tax. This leads to increased instances of rent arrears, housing instability, and potential eviction.

The policy particularly impacts working-age tenants with disabilities or caring responsibilities. They can need additional space in their homes but are penalized under the Bedroom Tax rules.

Extension to Pensioners (Announced but not Applied)

Although initially proposed to include pensioners, the extension of the Bedroom Tax to this demographic faced backlash and was not implemented.

Policy adjustments and exemptions were made to prevent the application of the Bedroom Tax to pensioners, following significant public opposition.

Arguments from Supporters and Critics

Supporters argue that the Bedroom Tax encourages efficient use of social housing, reducing overcrowding and incentivizing downsizing to more suitable properties.

Proponents also claim that the policy helps control housing benefit expenditure, ensuring taxpayer money is used effectively.

Critics argue that the Bedroom Tax disproportionately impacts vulnerable individuals and families, including those with disabilities and low incomes.

Critics argue the policy neglects housing affordability’s root causes, penalizing tenants for uncontrollable circumstances rather than addressing them.

Additionally, opponents argue that the Bedroom Tax exacerbates inequalities. It contributes to social exclusion, making it difficult for affected tenants to access essential services and maintain stable housing arrangements.

What were the goals of UK welfare reforms?

During the 2010–2015 Coalition Government, led by Prime Minister David Cameron, the UK implemented a series of sweeping welfare reforms. These reforms aimed to restructure the welfare system, making it more efficient and sustainable.

These reforms were part of a broader agenda focused on reducing government spending and promoting fiscal responsibility. One notable reform was the introduction of the Bedroom Tax, officially known as the under-occupancy penalty. It aimed to address what was perceived as the underutilization of social housing.

The policy aimed to encourage tenants with spare bedrooms to downsize, freeing up larger properties for needy families and cutting housing benefit costs. The government introduced Universal Credit alongside the Bedroom Tax to simplify benefit claiming and encourage employment, overhauling the system.

Additionally, the welfare cap was implemented to limit the total amount of welfare benefits a household could receive, aiming to control government spending. Changes to disability benefits, such as the transition from Disability Living Allowance to Personal Independence Payment, were implemented as part of reforms.

These changes aimed to ensure that support was targeted to those most in need. These reforms were intended to promote fiscal responsibility and streamline the benefits system.

However, criticism and controversy arose over their impact on vulnerable individuals, sparking debates on fairness and social justice in the welfare system.

Other ways you can get an extra bedroom

You can be eligible for an additional bedroom under certain circumstances:

- If you have a child or a ‘qualifying young person’ under the age of 20 placed with you for adoption.

- If you are a foster parent or a kinship carer, particularly in Scotland.

- You can be approved as a foster parent for a limited period of up to 52 weeks. However, during this time, you must not have a child or qualifying young person placed with you.

- It could also apply if you are an approved carer under an adult placement scheme, allowing for a temporary extra bedroom allocation.

How the bedroom tax could affect you?

The Bedroom Tax regulations determine if you have one or more spare bedrooms. Your total ‘eligible rent’—the maximum amount covered by Universal Credit housing costs or housing benefits—will be reduced accordingly.

The reduction percentages are as follows:

- 14% reduction if you have one spare bedroom.

- 25% reduction if you have two or more spare bedrooms.

If your weekly rent is £100, having one spare bedroom would reduce the eligible rent to £86, a deduction of £14. If you have two or more spare bedrooms, the reduction would be £25 a week to £75.

Your Universal Credit or Housing Benefit entitlement will then be calculated using this reduced amount. The amount of financial support you receive towards your housing costs will be adjusted.

Further, this adjustment will be made based on the number of spare bedrooms determined by the Bedroom Tax laws. This change can result in a reduction in your overall housing benefit claim.

FAQ’s

Is there still a bedroom tax in the UK?

Yes, the bedroom tax applies if you are of working age and renting from a local authority, a registered housing association, or other registered social landlord.

Do you pay room tax in the UK?

Yes, if you have a spare bedroom and you’re renting a council or housing association property, your Housing Benefit or housing costs element of Universal Credit could be reduced, commonly referred to as the ‘Bedroom Tax’ or ‘under-occupation penalty.’

Who introduced bedroom tax in the UK?

The policy was introduced as part of the Welfare Reform Act 2012 during the Premiership of David Cameron.

Final Words

The Bedroom Tax cuts housing benefits for tenants with extra bedrooms, affecting those in Housing Association or Council properties. London Living Rent makes housing more affordable by setting rents based on local earnings, helping people save for homes.

Both aim to tackle housing issues but in different ways. Bedroom Tax saves money, London Living Rent offers affordable housing options, aiding Londoners in securing stable accommodation.